Enhance the ROI of your digital campaigns

Aggregate data from all your sources to measure the true ROI of each campaign: web and app analytics, media platforms, and commercial data.

Technologies designed to optimize your digital acquisition

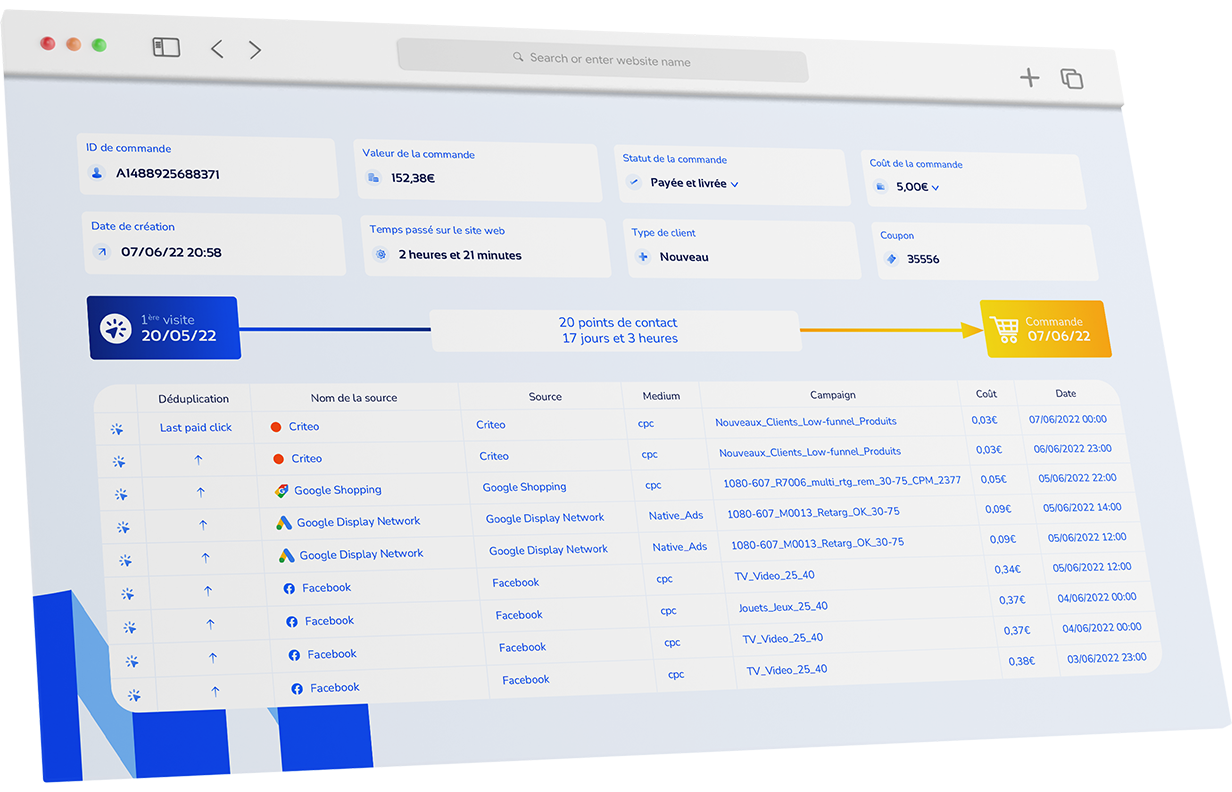

Trackad 360

Optimize your e-commerce acquisition campaigns:

- Identify the contribution of each channel and campaign

- Analyze the profitability of each acquisition source

- Automate and centralize data collection and reporting

Trackad Lead

Optimize your lead acquisition campaigns:

- Analyze the profitability of your multichannel Lead Generation campaigns

- Track the conversion funnel from cold lead to sale

- Reconcile all your online and offline data sources

Trackad Collector

Save your digital teams valuable time:

- Automate data collection from all your traffic sources

- Unify and control your acquisition data in real time.

- Automatically feed your reporting tools with all collected data

Trackad Affiliate

- Detect fraud and commission errors in your programs

- Monitor the performance of your affiliates with first-party data

- Automate data collection and monthly closings

Discover why you won't be able to

live without TrackAd

Unified vision

Find all your data sources in one place.

Merge and centralize all your data in a single interface. Web and app analytics solutions, media platforms, commercial data: data is collected, processed, and presented to facilitate your decision-making. All that’s left is for you to make the call!

Mastered media mix

Time savings

Holistic approach

Marketing Director, Stych

The tool is ergonomic and simple, while remaining financially affordable. It’s “simple is smart.” I really appreciate the customizable aspect of the tool. It’s not about buying an attribution model, but about...

CRM and Traffic Assistant, Alinea

We chose the TrackAd tool to provide a more in-depth attribution view following the analytics platform switch from GA to AT Internet. The goal was to have a better understanding of our...

CEO, Atlas for Men

TrackAd has been a valuable asset for analyzing our performance. The platform has allowed us to better understand our marketing mix and the contribution of different traffic sources to new customer acquisition.

...

Digital and CRM Director, BÉABA

The interface is very clear, and it’s easy to get the hang of. The Customer Success team is always available to meet our business needs and provide additional analytical insights. I work...

Affiliate Project Manager, Cdiscount

The benefits of collaborating with TrackAd are significant. We were able to ensure the quality of our program while identifying optimizations with immediate benefits. We continue to use TrackAd’s anti-fraud protection, which...

European Commerce Executive, Dyson

We have requested to set specific metrics and even ways of tracking (in first click instead of last click for different types of affiliates) and it was fast and effective. Now we...

Every day, our teams work to help advertisers like you exceed their digital acquisition goals.

Whether you’re in e-commerce or lead generation, our mission is simple: to provide you with the technology and expertise necessary to achieve maximum ROI with every campaign.

Our Customer Success team is here to anticipate your needs, boost your performance, and support you. Their expertise, responsiveness, and friendliness are universally recognized by our clients.

- Quick integration in 2 hours for immediate performance: Enjoy non-intrusive technology: no tags, no cookies, no scripts.

- Services dedicated to achieving your goals: Technical audits, campaign analysis, media mix strategy.

- More than just a tool… Join our ecosystem and benefit from our training, workshops, and events!

Take your digital acquisition to the next level now